Risk management

Description of the risk management system

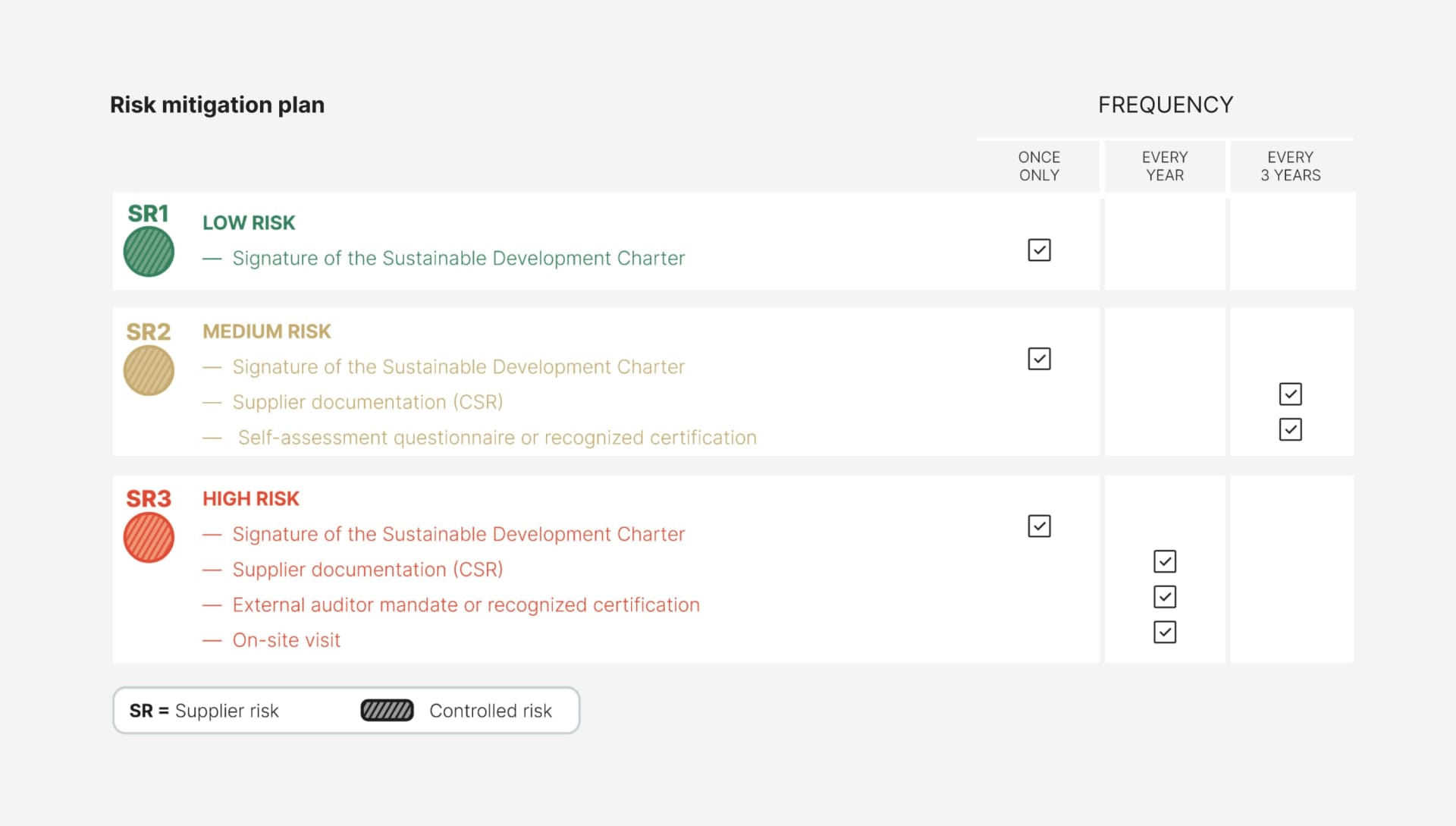

In response to the requirements of the Swiss Ordinance on due diligence and transparency regarding minerals and metals from conflict-affected areas and child labour (ODiTr) of 3 December 2021, Rolex has established a risk matrix that identifies and assesses the likelihood and severity of risks in its supply chain, in terms of human rights and the environment. Within this framework, the severity of a negative impact is judged individually and per industrial sector according to the gravity, scale and irremediable nature of the damage. Probability is defined by the possibility of this impact occurring. Updated annually in view of geopolitical, media and sector- specific realities, this risk matrix is an essential governance tool for managing purchasing within each industrial sector worldwide.

Risk matrix

The matrix is used to prioritize risk and supply perimeters. On this basis, an annual due diligence programme is carried out to accurately analyse the supply chains and calculate the risks associated with the location of suppliers. This work makes it possible to define the scope of the annual due diligence in accordance with the criteria set out by the applicable regulations. The steps described below are implemented within this scope. The risk matrix includes the following categories:

— Governance: money laundering and funding terrorism, supporting armed groups, non-compliance with taxes, fees and charges, illegal mining, child labour.

— Social: forced labour, discrimination, harassment, non-respect of freedom of assembly and association, deprivation of land; violation of the right to privacy, decent working and living conditions, health and safety, gender equality.

— Environment: soil pollution and biodiversity damage, deforestation, waste and pollutants.

Risk identification channels

Mapping

Rolex launched a mapping campaign, starting with supply chains that present a risk. Within this framework, its purchasers – in collaboration with tier 1 suppliers (Rolex’s direct suppliers) – identify and assess the risks associated with the following tiers in the supply chain.

Each supplier must be transparent and provide all the information it can to allow Rolex to map its supply chain, specifying the origin of the materials used, the sites and the product manufacturing context.

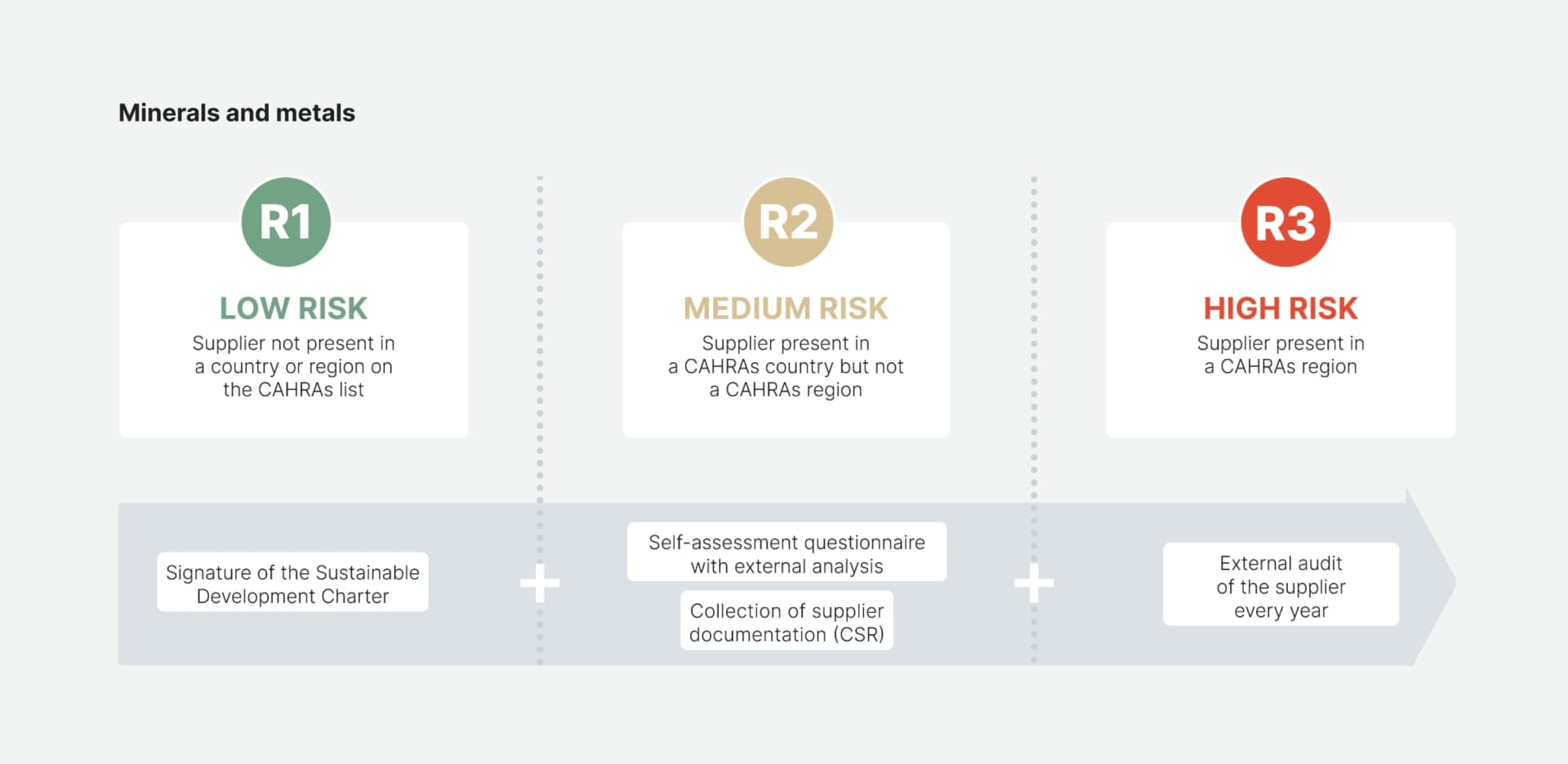

Minerals and metals

For minerals and metals, the mapping involves tracing supply chains by identifying the suppliers of Rolex’s tier 1 suppliers included in the annual scope.

The exercise is repeated for each tier in the supply chain to map risks back to the mine or as far upstream as possible if the supplier is certified.

If the certifications correspond to those recognized by Rolex, the certifications produced by the suppliers and their own suppliers guarantee the absence of minerals and metals sourced from conflict-affected areas upstream in the supply chain. Rolex thus inherits the due diligence performed by its suppliers. In this case, it is not necessary to go up the chain to the mining source.

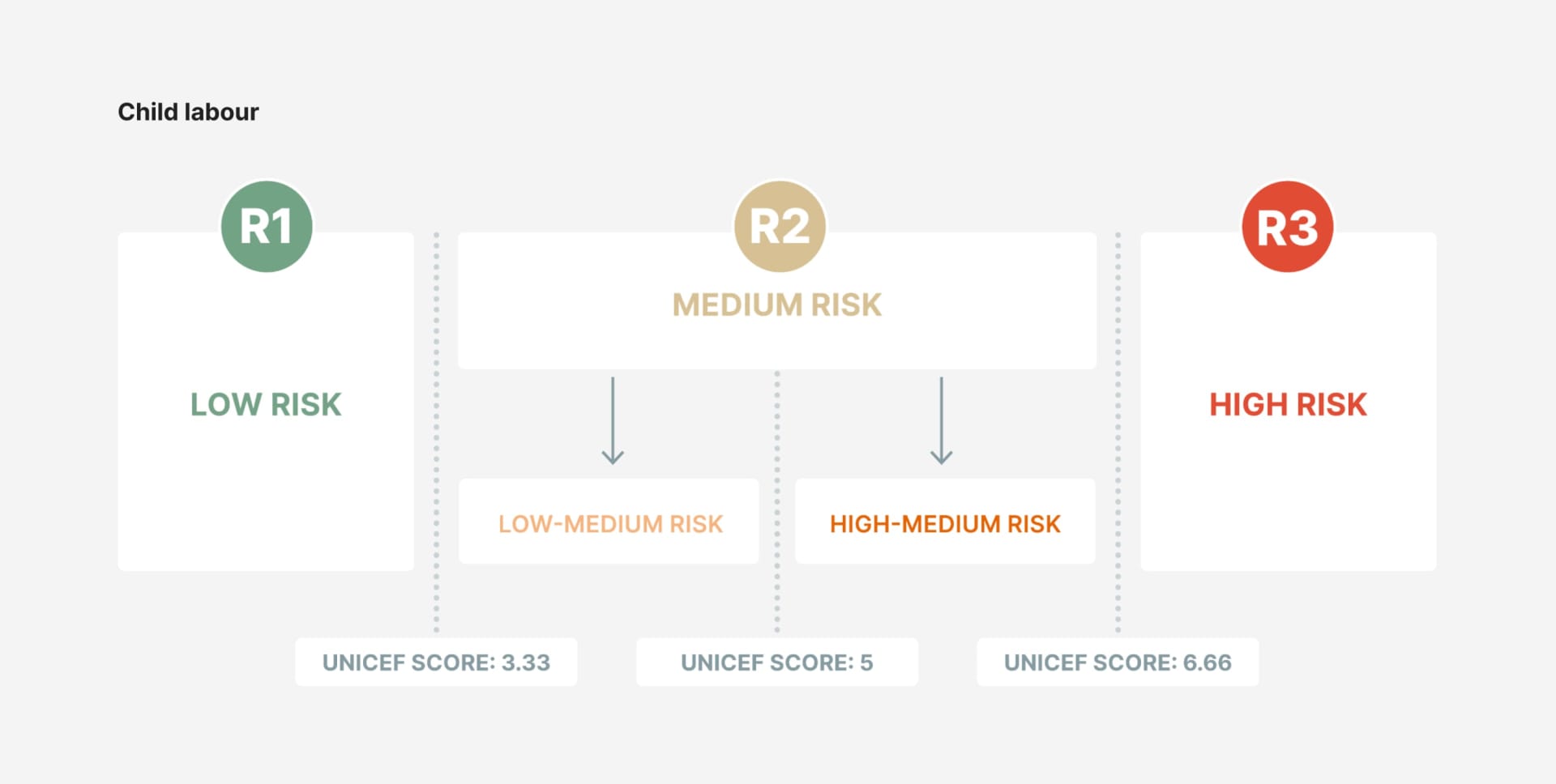

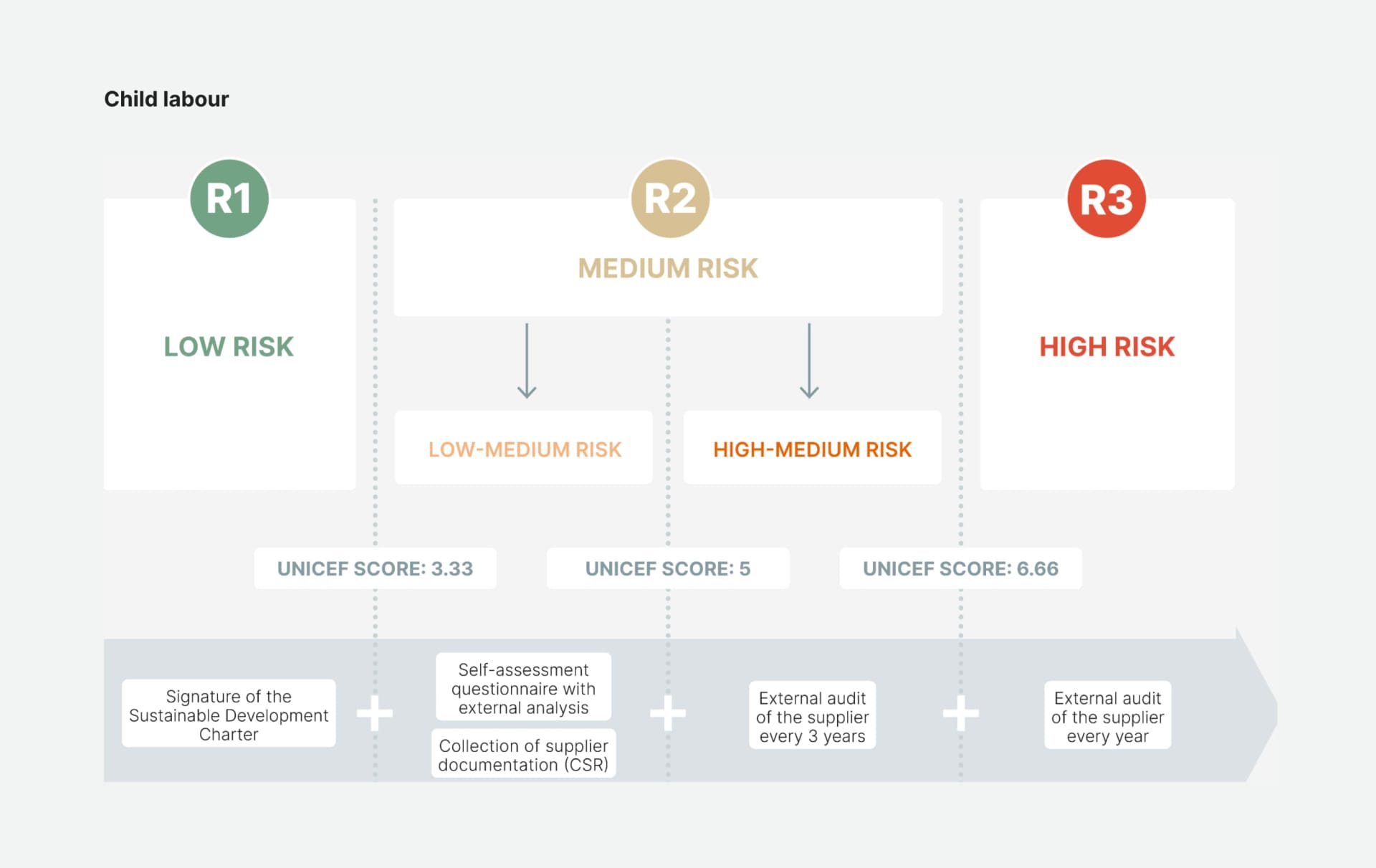

Child labour

With regard to child labour, Rolex relies on the address of the supplier as well as the ‘made in’ designation (country of production according to the indication of origin) of the product or service sourced. The ‘made in’ designation enables the company to protect itself if a tier 1 supplier is only a distributor located in a territory identified as risk free. In this case, Rolex traces the production location of the good or service supplied.

Given the diversity of goods and services supplied in its supply chain, Rolex takes a large quantity of data into account, including the ‘Swissness’ self-sufficiency rate and the customs certificate of origin. The aim is to determine whether the good or service was produced in Switzerland or in which country most of the added value was provided.

Monitoring

Rolex continuously monitors geopolitical, media and sector-specific current events in connection with industrial sectors and suppliers. This monitoring is integrated into each stage of the life cycle of its suppliers’ goods or services. It is also reinforced when a potentially high-risk supplier (in terms of child labour or minerals and metals) is added. Rolex’s aim is to guard against all risks before entering into a commercial relationship. Monitoring also makes it possible to anticipate the implementation of new regulations concerning due diligence worldwide.